Blog

Metaverse-Banking: New Horizons for the Financial Sector

- Hot Topics

- Blog

The Metaverse is on the rise and is transforming the way customers interact with businesses and conduct transactions. Numerous industries are already developing applications for Metaverse technologies, including Mixed Reality billboards, virtual meetings with avatars, immersive showrooms, and three-dimensional AR models for shopping. Banks and insurance companies are no exception. In this article, we will examine how the Metaverse could revolutionize banking and what opportunities and challenges arise for the finance sector.

New to the Metaverse? If you’re looking for information about the Metaverse, we recommend reading our free info kit.

Are you already familiar with the topic? Let’s dive a little deeper into the subject matter.

From Branches to the Metaverse

Not long ago, traditional banking centers was the place where customers had personal contact with their financial advisors. This was a setting where customers were updated regularly, leading to the identification of more sales opportunities. However, as the digitalization of finance advanced, many cost-intensive branches have been closed, elevating the role of online banking. This digital transformation makes it necessary for financial service providers to constantly adapt their business models and value chains. While this increases efficiency, it also means that personal contact can become somewhat secondary. The Metaverse now offers new opportunities for re-establishing this level of personal interaction with customers, even in a digital space.

“Customers have lost the personal touch with their traditional banks, which was largely human relationship management,“ writes Retail Banker International.

Some financial institutions are already active in the Metaverse and are experimenting with different approaches. JP Morgan, for instance, operates a digital asset marketplace in Decentraland, while Deutsche Bank launched a 3D lounge featuring a range of content, avatars, and events. HSBC is engaged in e-sports within the Sandbox. One downside to using international crypto-gaming platforms is that the data is hosted outside the EU and is not compliant with the European General Data Protection Regulation (GDPR).

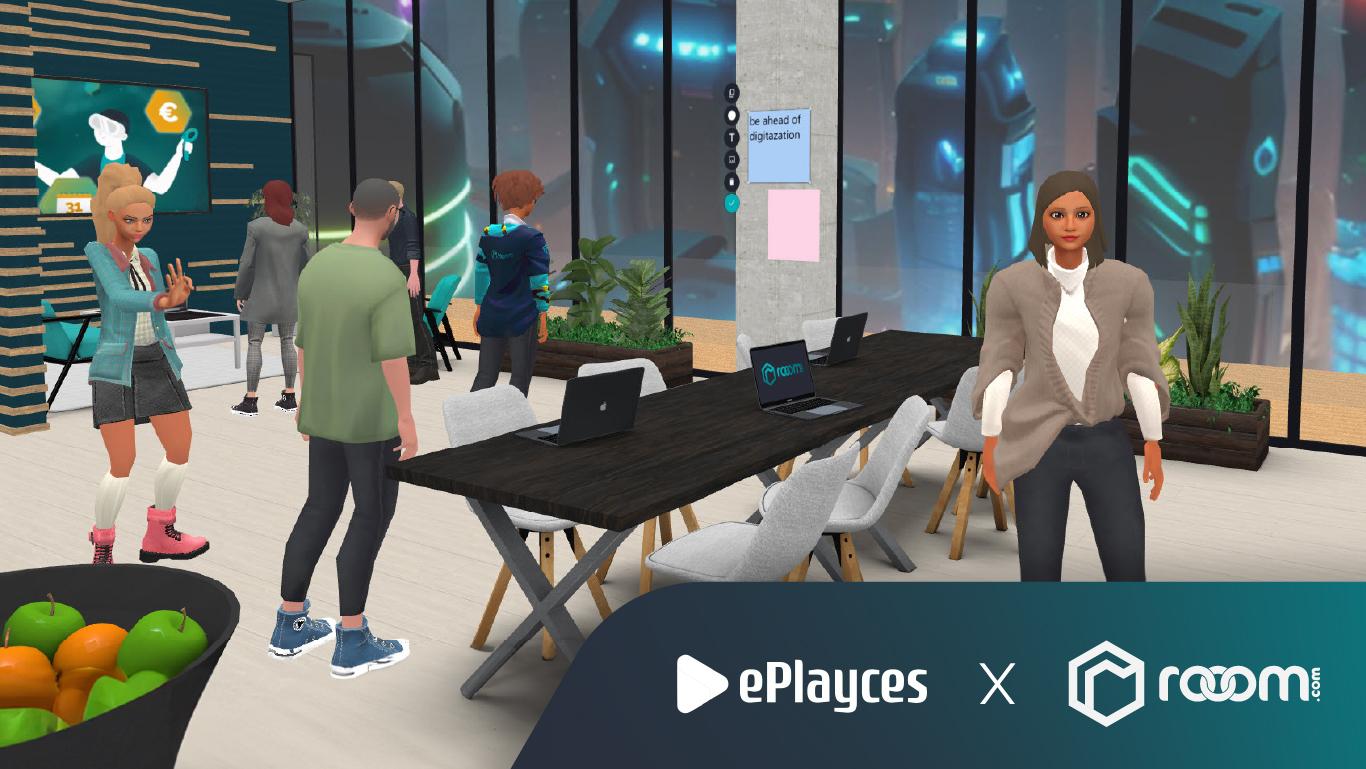

However, even within the DACH region, there are professional Metaverse platforms specializing in the secure handling of user data, such as the Enterprise Metaverse Solutions by rooom. The Metaverse offers much more than just gaming; in the business sector, there are already numerous approaches and use cases that can enrich both daily work and customer relationships.

Benefits for the Finance Sector

The Metaverse provides financial institutions with innovative approaches for creating new customer experiences that extend beyond the traditional boundaries of financial services. The following aspects are essential for a „Banking Metaverse“:

Virtual Branches. Numerous physical branches had to close, but virtual branches could be a promising alternative to maintain personal customer service with lower operational costs. Hybrid models, which combine virtual and physical realities, also offer new possibilities in service. Here, customer consultation can be performed both by avatars and human staff in the virtual realm.

The integration of artificial intelligence allows for customized financial product and insurance recommendations based on individual customer preferences. Mortgages and insurance for purchasing virtual land and property in the Metaverse could also present interesting opportunities.

Customer Retention. The Metaverse offers a new channel for reaching younger customers where they are most active. Especially, the target group of Digital Natives is no longer hesitant about the Metaverse because they’re familiar with gaming and shopping. "The Metaverse is where our target audience of tomorrow is found," agrees Tim Alexander, Head of Global Brand & Marketing at Deutsche Bank.

Meetings and Collaboration. Meetings in 3D environments are more engaging and interactive than a simple video- or teleconference. This is a game-changer for teams spread across the globe, strengthening the team spirit while simultaneously stimulating creativity. Through 3D simulations, it is even possible to walk through a business client’s production facilities with them and virtually assess new machinery before granting an investment loan.

Education and Training. Virtual learning environments in the Metaverse offer new opportunities and creative concepts for both training and development programs. Staff can be prepared for hazardous situations, such as bank robberies, through virtual simulations. Furthermore, during remote learning, employers can boost motivation by providing engaging experiences and regularly offering new content for them to learn on their own.

Simplify access. Not everyone’s got a VR headset or the right tech to dive into Virtual Reality from their homes. Therefore, it is crucial to start with low-threshold solutions and prepare for the increasing availability of access hardware and headsets. Web-based 3D spaces work great to get started because you can just pull them up on your PC or smartphone in a browser.

Decentralization: NFTs, Blockchain, and cryptocurrencies operate on a decentralized system, meaning central financial institutions are no longer strictly necessary in Web3.

Therefore, banks need to differentiate themselves through other services with added value, such as the secure exchange of cryptocurrency into fiat currency.

A new place for transactions: Assets are moved between the real and the virtual world. Payment systems and transactions take place via Metaverse platforms. Here, banks can play a crucial role by aiding and securing the integration of financial transactions with their expertise.

Security and Data Protection: The regulatory requirements and data protection guidelines for the Metaverse have yet to be defined. Identity verification through Web3 tokens could serve as a key component to ensure the security of sensitive customer data within the Metaverse.

Preparation & Initial Steps in the Metaverse

“Metaverse is the next frontier of banking to transform customer engagement.”– Match-Maker Ventures

Following the Metaverse trend is particularly important for the image of banks to be seen as pioneers. It is crucial to position oneself as a trustworthy institution with expertise, capable of supporting customers in this new digital environment. With new technologies come new tasks and challenges for financial service providers. Therefore, it is important to act now and gain the appropriate knowledge.

Depending on the target group, different concepts can be interesting for banks and insurance companies. For private customers, a virtual or hybrid branch with advisory services could be suitable, while the focus for business clients might be more on financing. 3D visualizations of production machines, wind turbines, etc., can be useful to inspect the object in need of financing in advance. Virtual spaces also offer new possibilities and creative approaches for internal training and employee collaboration. Authentication and token-gating (access restrictions) through blockchains provide additional security in the Metaverse.

To find the right concept, you should initially analyze the needs of your existing customers. What interests and prior knowledge do they possess? Are you targeting a young, tech-savvy audience or aiming to adress long-standing customers? Existing online banking systems will not be replaced in the long term, but rather expanded. The Metaverse offers us a new perspective and even more opportunities for interaction. Specifically, in customer service, we have to adapt to a new form of interaction and collaboration. Many financial providers rely on specialized guidance or collaborations with start-ups and FinTechs when entering the Metaverse.

At rooom, you’ll find tailor-made Metaverse solutions for the areas of banking, finance, and insurance. We offer not only an excellent 3D platform but also provide consultation and support for all steps – from concept to implementation.